|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Mortgage Interest Rates Forecast: What to Expect in the Coming MonthsAs the housing market continues to evolve, understanding mortgage interest rates is crucial for prospective homebuyers and those looking to refinance. In this article, we delve into the forecast for mortgage interest rates and what it means for you. Current Trends in Mortgage Interest RatesThe current mortgage interest rates have shown a steady pattern over the past few months. Economic indicators suggest potential shifts that could impact these rates. Economic Factors Influencing RatesInflation plays a significant role in determining mortgage rates. As inflation rises, so do interest rates, to compensate lenders for the decreased purchasing power of future payments. The Federal Reserve's policies are another critical factor. When the Fed adjusts the federal funds rate, it indirectly influences mortgage rates. Predictions for Future Interest RatesExperts forecast a moderate increase in mortgage rates over the next few quarters. This is largely due to anticipated changes in economic policies and inflation trends. Impact of Global Economic ConditionsGlobal economic conditions, including international trade tensions and economic growth rates, can also affect U.S. mortgage interest rates. A strong global economy can lead to higher rates.

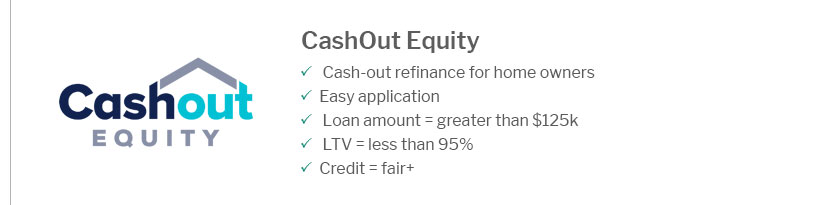

Strategies for HomebuyersFor those considering purchasing a home, understanding these trends is crucial. Locking in a rate now could be advantageous if rates are expected to rise. Refinancing OptionsConsidering mobile home refinance options might be wise for current homeowners. With potential rate increases, securing a lower rate now could lead to long-term savings. FAQ Section

Staying informed about mortgage interest rate forecasts and economic conditions will empower you to make sound financial decisions whether you're buying a home or refinancing an existing loan. https://www.morganstanley.com/insights/articles/mortgage-rates-forecast-2025-2026-will-mortgage-rates-go-down

After the 2020 pandemic, the Federal Reserve Board (the Fed) slashed rates, which helped drive 30-year mortgage rates to a low of 2.65% in early 2021,2 sparking ... https://www.forbes.com/advisor/mortgages/mortgage-interest-rates-forecast/

According to the MBA February Mortgage Finance Forecast, the real estate finance association projects the 30-year fixed-rate mortgage to average 6.9% in the ... https://www.cnet.com/personal-finance/mortgage-rate-predictions-rates-fluctuate-over-economic-uncertainty/

The average rate for a 30-year fixed mortgage has moved between 6.9% and 6.6% in recent weeks, according to Bankrate data. Fannie Mae projects mortgage rates to ...

|

|---|